The current state of paper in finance

In finance, mountains of paperwork have long been the norm. From invoices and receipts to contracts and financial reports, the sheer volume of paper circulating through departments can be overwhelming. However, this reliance on paper comes at a cost - both figuratively and literally.

There are many reasons why paper consumption is problematic. One of the most widely known issues with paper is that its production process is one of the biggest causes of pollution worldwide - polluting air, water, and land. Besides this, there are several other problems relating to its consumption:

Costly

On average, businesses spend around $48,000+ per year on paper and paper-related costs, such as storage and labor.

Easy to lose

Paperwork is handled multiple times and often by numerous people, making it easy to lose important documents as they may be misplaced during processing or misfiled.

Lack of security

Not only can documents be stolen, but fires, floods, and other hazards can also damage them, leading to a loss of important information.

Time-consuming

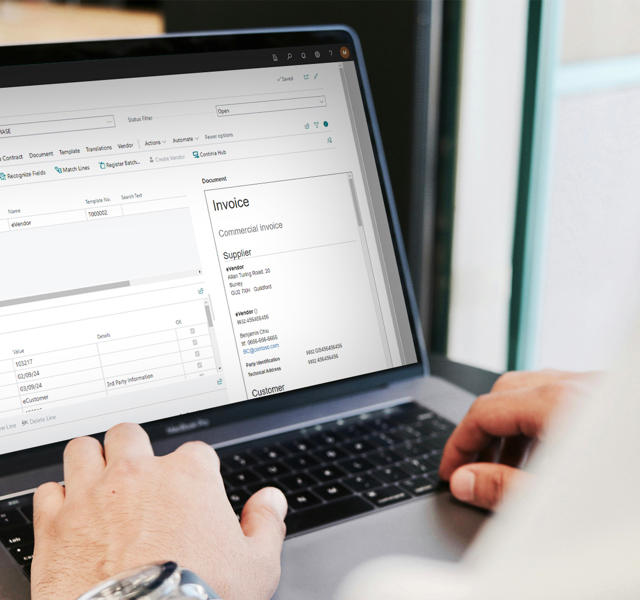

Manual data entry takes a long time and, if you don't do it properly, it can be full of errors that need correcting.

Productivity killer

Paper-based processes lead to slower turnover and unhappy employees, negatively affecting your bottom line.

Non-compliance risks

With more countries enacting legislation that mandates electronic document storage and exchange, sticking to paper-based systems puts you at risk of legal penalties.