Embracing digital transformation

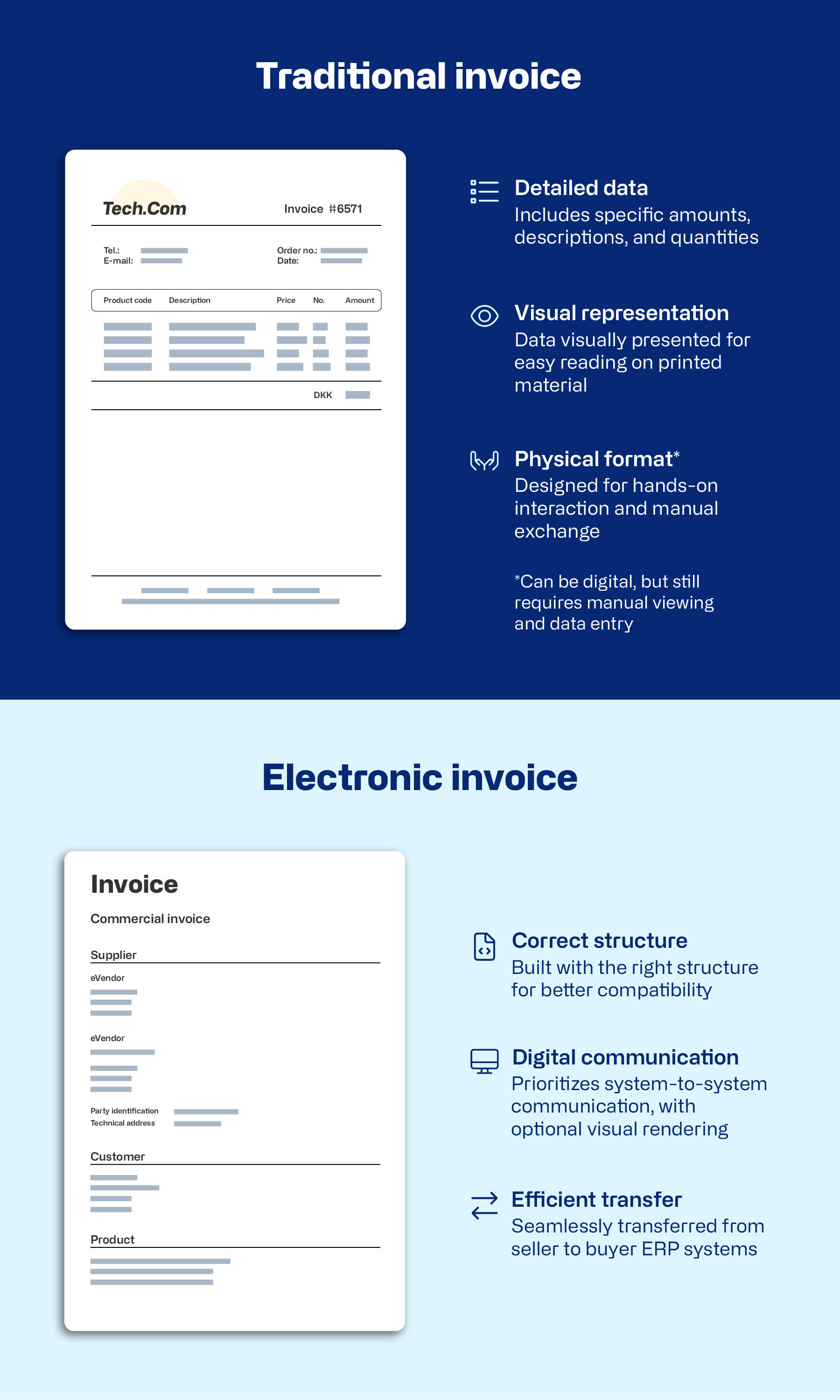

Digital transformation is reshaping every aspect of business. Companies worldwide are navigating the transition from traditional to digital processes, seeking efficiency, accuracy, and sustainability. Among the many digital practices being adopted by finance departments, e-invoicing is becoming pivotal to modern business practices.

This comprehensive e-invoicing guide dives into what it is, the benefits and challenges, the global landscape, and how businesses can seamlessly implement electronic invoicing in their digital operations.