Sustainability: Reshaping corporate success

With the advent of the Corporate Sustainability Reporting Directive (CSRD) in January 2023, sustainable practices started reshaping corporate success, blending environmental responsibility with financial savvy. Placing importance on ESG factors is now proven to have a direct and positive impact on business profits and revenues.

In this emerging reality, going green is not just an ethical choice but a strategic one for future-focused businesses and their success, with the advantage of enhanced brand reputation and transparency, increased customer and investor trust, and lower operational costs due to more efficient use of resources.

Sustainability reporting frameworks

Reporting frameworks, among which, the European Sustainability Reporting Standards (ESRS), Global Reporting Initiative (GRI), and Sustainability Accounting Standards Board (SASB), are used to assess an organization's activities impact on the different aspects – environmental, social, governance – of the business and inform the industry on what and how to report.

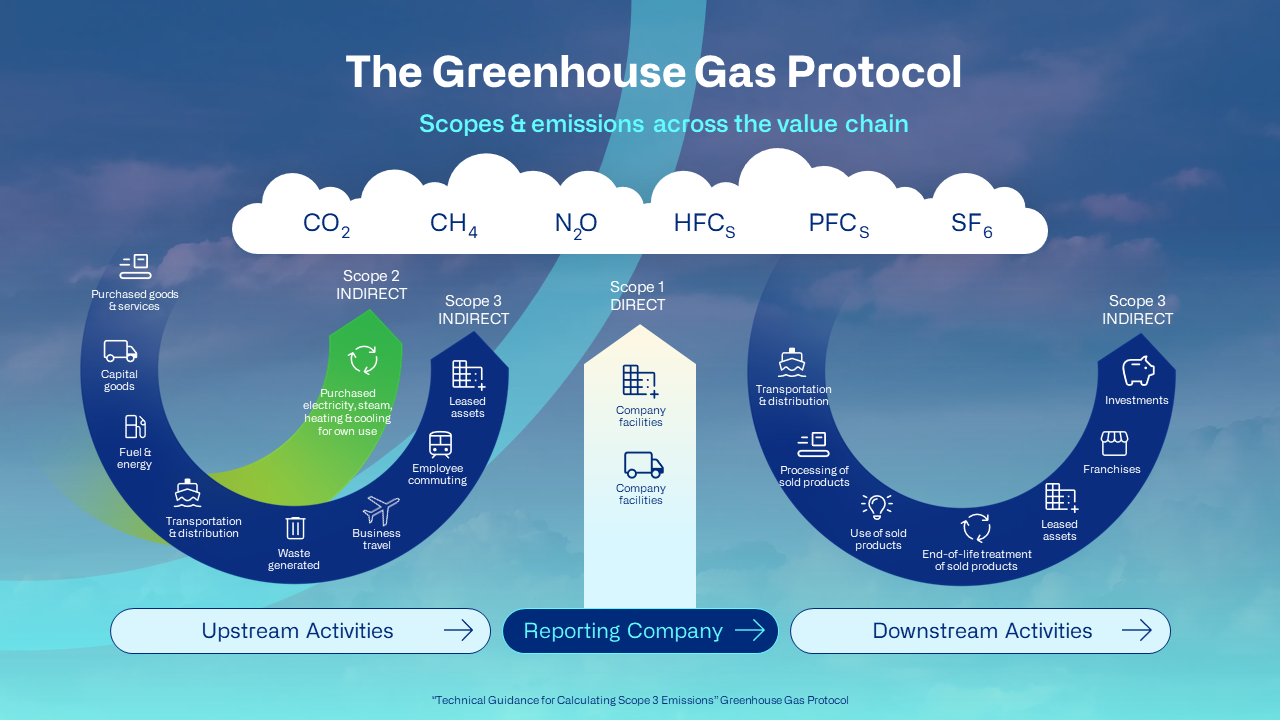

Carbon accounting, in particular, is crucial to the environmental part of ESG reporting, as it enables companies to calculate their GHG emissions and report on their total environmental impact, the first and fundamental step towards the successful implementation of climate change mitigation strategies. CA allows businesses to break down their carbon emissions according to their sources, identify the most polluting activities in their operations and value chain, and act accordingly.